Run Automated Use Tax Analytics & Real-Time Corrections with Diagnostax

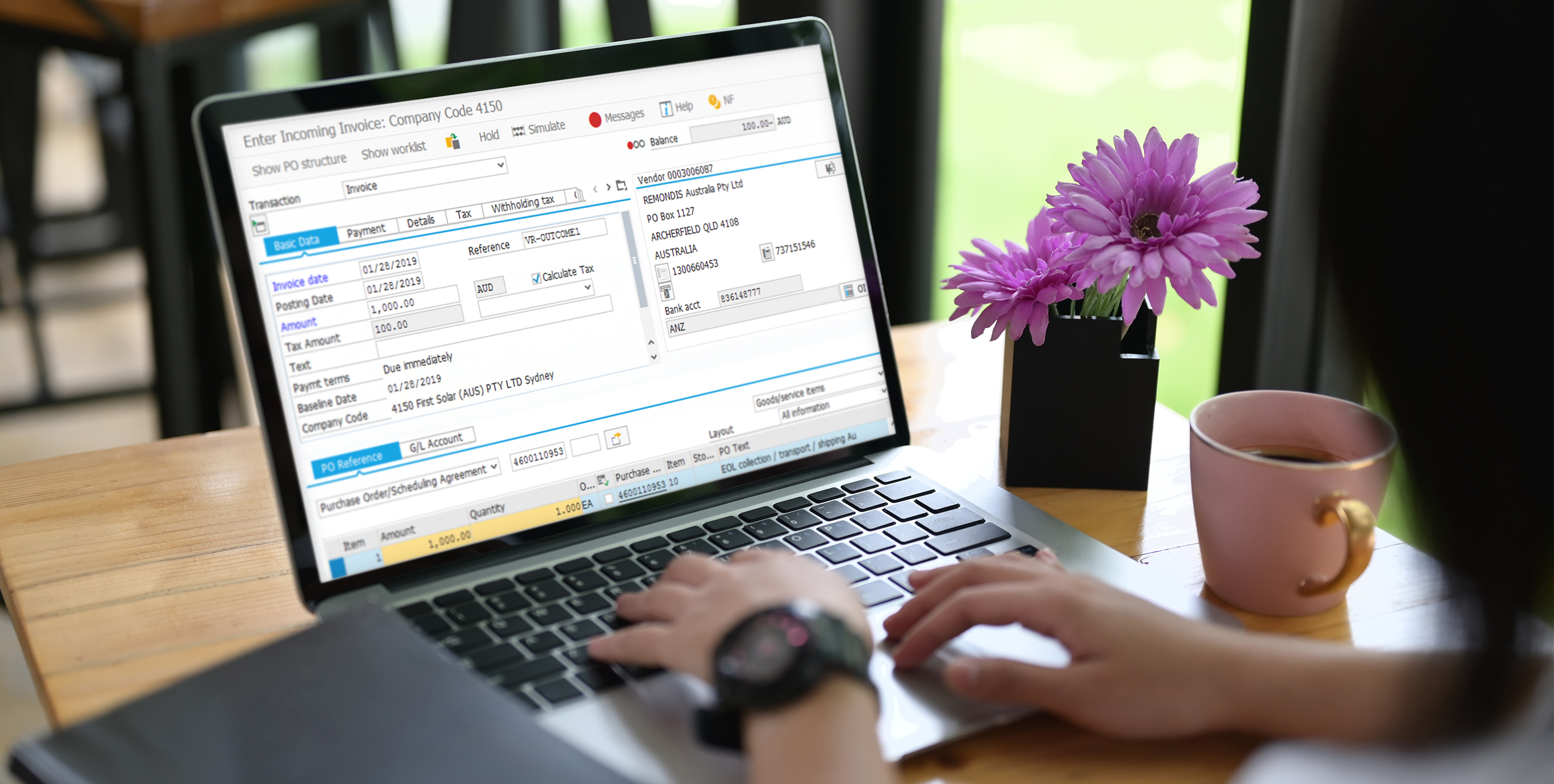

Automate the comparison of actual to expected tax results with advanced tax data analytics for A/P transactions, powered by tax compliance tools for SAP.

Supports P2P for Sales & Use Tax.