Increase Tax Data Accuracy

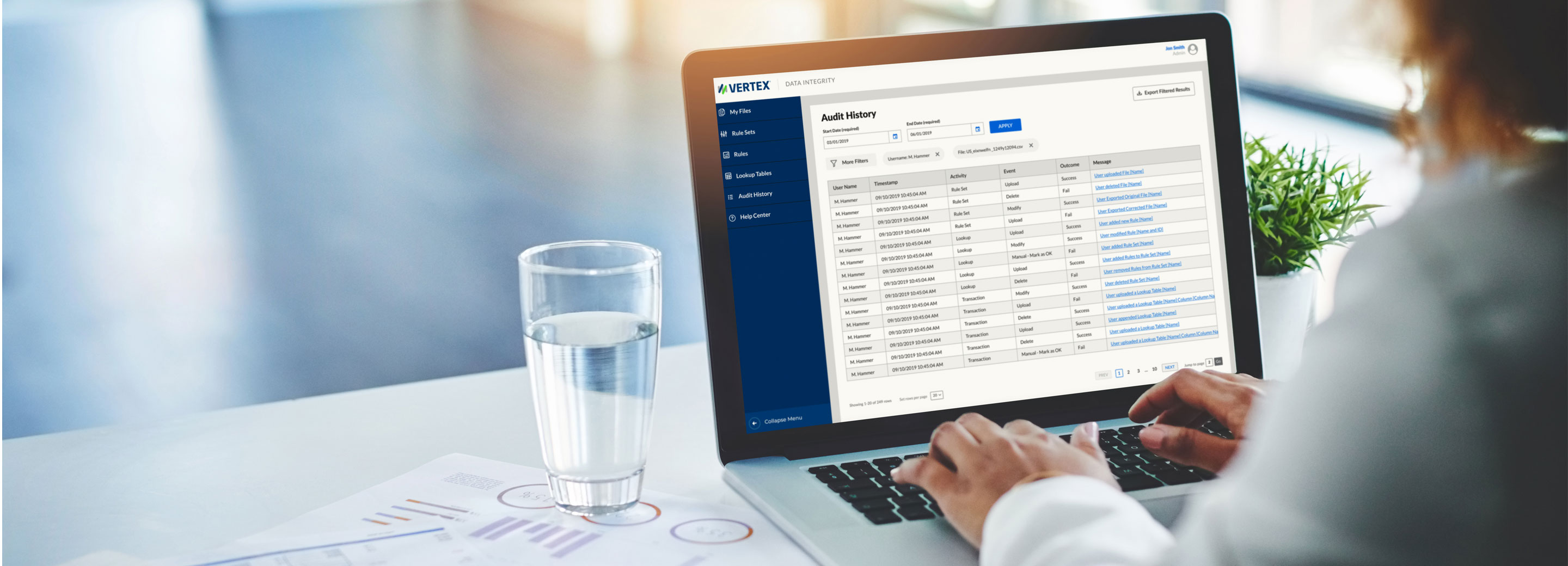

Validate, enrich, and transform the transaction and tax data required to support compliance processes. Drill down to the details needed to save time improve audit performance.

Tools to improve data quality and provide data intelligence to optimize the end-to-end tax process and improve business outcomes.

Today’s tax function has access to the most comprehensive data set in the organization. Integrated, tax-specific data tools can not only improve compliance and audit performance, but unlock that data for strategic insight to drive business decision-making.

Data and insight solutions integrate with your ERP systems and Vertex applications to not only enhance data quality but integrate and analyze data sources to reveal actionable insight.

Validate, enrich, and transform the transaction and tax data required to support compliance processes. Drill down to the details needed to save time improve audit performance.

Improve your confidence in compliance data and leverage data intelligence to mitigate risk more proactively.

Data intelligence dashboards reveal what’s behind the data. View trends, highlight exposure and risk, and pinpoint areas for priority attention. Become a more proactive tax function.

Leverage data intelligence tools to turn raw data into actionable insight to not only optimize tax performance, but to model, predict, and influence decision-making across the organization. Leverage data to support business partners to drive better outcomes.

Data intelligence to improve tax performance, and insight to drive business decision-making.

Automate the tax data validation, analysis, and transformation steps required to support indirect tax compliance.

This infographic illustrates how Vertex Cloud Data Integrity helps companies reduce their audit exposure and increase tax staff efficiency.

View the infographic to learn how re-balancing tax department activities is the first step to elevating the strategic value of the tax department, and how data intelligence is the key.

We harness the strengths and abilities of our partners and alliances to deliver trusted tax solutions to businesses across the globe.