Empower your tax staff with an easy-to-use, purpose-built tool for tax.

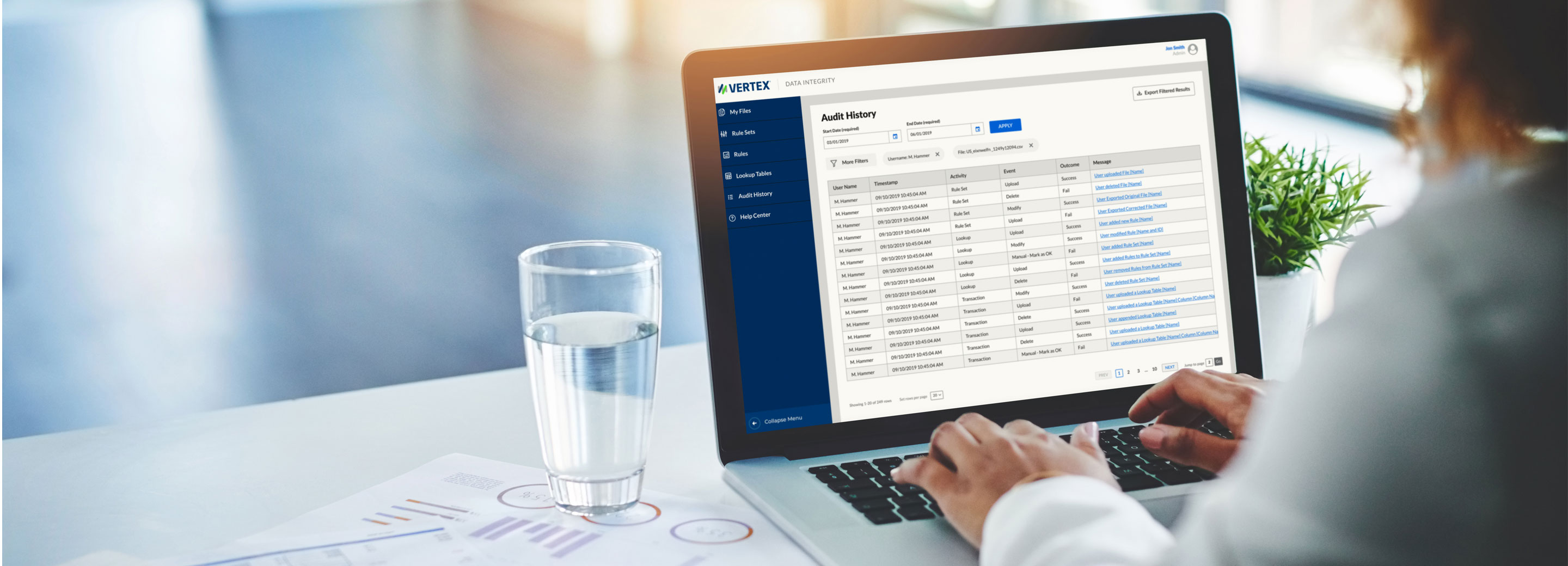

Confidently manage your tax data with sophisticated validation, enrichment, and transformation capabilities through a simple, tax-specific UI.

- Cloud-based, modern user interface

- Designed for tax professionals

- Maximized responsiveness, efficiency, and design for an exceptional user experience

- Scalable for handling high volumes of data.