Major EU VAT changes for digital platforms facilitating sales of low value goods

From July 1, 2021, EU VAT rules on the cross border supply of low value goods change dramatically with new reporting obligations for digital platforms.

Online selling into the EU is about to change dramatically. From July 1, 2021, digital platforms (e.g. online marketplaces) will be liable for the collection and remittance of VAT on sales made via their platform. The VAT due is set to be based on the place of consumption of the consumer as the EU extends the successful MOSS model, introduced in January 2015 for B2C digital services, to online sales of physical goods and remove the exemption on importation of low value goods.

The VAT e-commerce package, adopted in February 2020, is one of the European Commission’s priorities under the Digital Single Market strategy with the noble goals of facilitating cross-border trade, combating VAT fraud and ensuring fair competition for EU businesses. The Commission has estimated that member states will gain €7 billion annually through increased VAT revenues.

One of the key features to achieve these goals is taxation at the place of consumption, no matter the origin of the goods, and the removal of the existing €22 import exemption threshold. In late September 2020, the Commission released its explanatory notes on the new rules. The notes provide more information on marketplace liability and how the new low value goods threshold of EUR150 is to be calculated.

The European Commission recently recently a 'Guide to the VAT One Stop Shop' to provide clarity to the rules coming into effect on July 1. It also includes additional information on technical specifications for the special schemes that come into effect. The key aim of this guide is to provide additional practical guidance.

EU VAT rules on low value goods mirror global implementations

These EU rules mirror those introduced on VAT/GST collection on the cross-border sale of low-value goods in Norway, Australia, New Zealand, and (from January 1, 2021) the UK.

The relevant thresholds in these jurisdictions are as follows: Norway (NOK 3,000, circa EUR270), Australia (AUD1,000, circa EUR605), New Zealand (NZD1,000, circa EUR560) and the UK (GBP135, circa EUR150). It also follows the recommendation in the OECD report on the role of digital platforms on collection of VAT published in 2019.

Due to the makeup of the EU, involving 27 member states, the changes are more complex. The explanatory notes shed further light on some of the key points which we will address in this article.

We are, specifically, going to assess the implications for digital platforms, or ‘electronic interface’ as referred to in the explanatory notes. The definition of a digital platform varies between the jurisdictions that have introduced new rules on the cross-border sale of low-value goods, e.g. in Australia they are referred to as Electronic Distribution Platforms (EDPs) while in New Zealand it is ‘online marketplace’. The EU approach follows that recommended in the OECD’s 2019 report on the role of digital platforms in the collection of VAT by providing a very broad definition. The EU explanatory notes definition is as follows:

Electronic interface – should be understood as a broad concept which allows two independent systems or a system and the end user to communicate with the help of a device or programme. An electronic interface could encompass a website, portal, gateway, marketplace, application program interface (API), etc.

Common examples of such electronic interfaces (EI) include Amazon and eBay, but as the above definition explains it can be extended to numerous types of online commerce systems.

Implications for electronic interfaces

The ‘deemed supplier’ provision

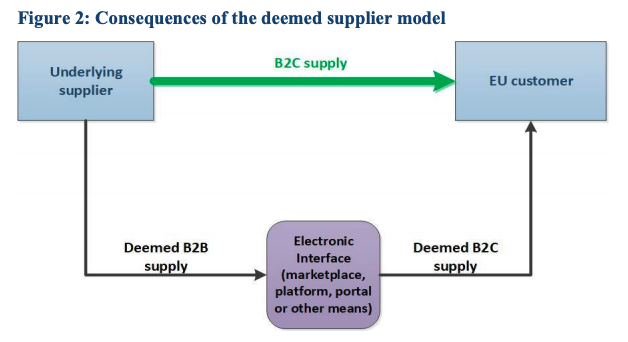

As we stated in the introduction to this article, from July 1, 2021, digital platforms that fit the above definition may be liable for the collection and remittance of VAT on imports into the EU of low value goods not exceeding EUR150 made via their platform and on any EU cross-border sale of goods from a seller not established in the EU. To do so, a legal provision has been introduced, that of the ‘deemed supplier’.

Credit: Above image is from page 14 of the EU explanatory notes

Article 14a of the EU VAT Directive states that “taxable persons who facilitate distance sales of goods through the use of an EI will be involved in the collection of VAT on those sales.” As a result, according to the explanatory notes, the EI that “facilitates the supply [of low value goods not exceeding EUR150] shall be deemed to have received and supplied the goods.” The EU’s reasoning for the introduction of the deemed supplier provision is to ensure the effective and efficient collection of VAT, while at the same time reducing the administrative burden for suppliers, tax administrations and consumers.

Platforms such as those only providing payment processing or online listing services, or those used to redirect customers to the sale, are excluded from the deemed supplier provision but still have reporting obligations.

VAT determination and knowledge of goods

In practice, the EI will need to be able to assign the correct VAT liability to goods sold on its platform in real-time at the moment of checkout.

For the same checkout basket, it is possible that the EI, the seller, or the end customer are liable for the VAT for different items within the same basket. It is also possible that within the same basket customer location determination and thus taxability will differ (e.g. mixed digital service and physical goods).

Assigning the correct VAT liability is complicated where goods from multiple sellers are in the same basket. It is necessary for VAT liability assignment to be performed at a line item level and on a seller/consignment level.

The EI, therefore, needs to collect at a minimum the following information:

- The underlying supplier’s place of establishment

- Description and value of goods sold

- The ‘ship from’ location (based on information available up to the point of check-out)

- The ‘ship to’ location (as above, based on information available up to the point of check-out)

In practice, this VAT determination needs to be done in real-time without disturbing the customer journey. This may mean that the EI has to issue multiple invoices for the same basket.

Burden of proof

While the EI is responsible for the collection of VAT, it needs to rely on the information that it receives from the seller in order to correctly manage the VAT. The EI will not be responsible for the collection and remittance of VAT if it “can demonstrate that it did not and could not reasonably know that the information received was incorrect.” It means that the burden of proof that all of the necessary conditions are met to benefit from the limited liability are with the deemed supplier (i.e. the EI).

The advice in the explanatory notes is that the deemed supplier should make “commercially reasonable and diligent efforts to collect all the necessary information from the underlying supplier so that it can fulfil its VAT obligations.” As per the explanatory notes this include:

- Communication with sellers highlighting the importance of the information for the correct collection of VAT, with appropriate guidance and FAQ or support teams

- Set up of reasonable verification processes on information provided by suppliers and product classification

- Set up other verification processes based on the data available from internal or external sources (e.g. the delivery time that can provide information on the origin of the goods)

Something also to take into account is how these rules will work in parallel with other obligations in certain EU countries of joint liability for the payment of VAT or additional reporting obligations.

Record-keeping obligations

As a result of being the ‘deemed supplier’ there are reporting obligations related to the collection and remittance of VAT due on the supplies made through an EI. The records of these transactions must be retained for 10 years. What records are kept depends on which special scheme the EI avails of.

The reasoning behind these record-keeping obligations is to ensure that the correct amount of VAT was collected and remitted to the relevant EU tax authorities.

When the EI uses the OSS scheme they need to retain the following pieces of information:

- The Member State of consumption to which the goods or services are supplied

- Type of services or the description and quantity of goods supplied

- Date of the supply of the goods or services

- Taxable amount indicating the currency used

- Any subsequent increase or reduction of the taxable amount

- VAT rate applied

- The amount of VAT payable indicating the currency used

- Date and amount of payments received

- Any payments on account received before the supply of the goods or services

- Where an invoice is issued, the information contained on the invoice

- In respect of services, the information used to determine the place where the customer is established or has his permanent address or usually resides and, in respect of goods, the information used to determine the place where the dispatch or the transport of the goods to the customer begins and ends

- Any proof of possible returns of goods, including the taxable amount and the VAT rate applied

It is important to note that EIs not seen as deemed suppliers (e.g. listing platform or service platform) will still have record-keeping obligations for a period of 10 years. These records must be sufficiently detailed and must be made available electronically when requested by any EU Member States.

Calculating the ‘intrinsic value’ of goods sold

Low value goods are “goods in consignments whose intrinsic value at import does not exceed EUR150”. In the case of multiple sellers in the same basket, the EI should be able to determine the ‘intrinsic value’ (not exceeding EUR150) per seller. The delivery fee or related insurance costs are excluded from the calculation, if they are indicated separately.

The EI needs to make the calculation in real time at the time of supply for the purpose of determining whether the sale of goods can be declared under the import scheme.

It is recommended that the EI indicates on the commercial document accompanying the consignment the price in EUR (or the local currency of the destination, if different), as determined at the moment of acceptance of payment. This value will be accepted by the customs authorities upon importation of the goods into the EU and thus prevent possible double imposition of VAT on importation due to exchange rate fluctuations.

Special schemes: OSS and IOSS

There are two special schemes introduced: the One-Stop Shop (OSS) and the Import One-Stop Shop (IOSS).

The OSS special scheme is effectively an extension of the Mini One-Stop Shop (MOSS) that was introduced in 2015 concerning the cross-border supply of digital services. The MOSS system branched into a Union and Non-Union scheme depending on the place of establishment of the supplier. This is replicated in the OSS system and there will now be quarterly VAT OSS returns to be filed by the end of the month following the end of the quarter, this differs from MOSS where the returns were filed by the 20th of the month following the end of the quarter.

The IOSS scheme is created for the sale of low value goods (not exceeding EUR150) from outside the EU to consumers in EU member states. The VAT charged on these sales will be reported via an IOSS return to be filed monthly by the 30th of the following month.

Invoicing

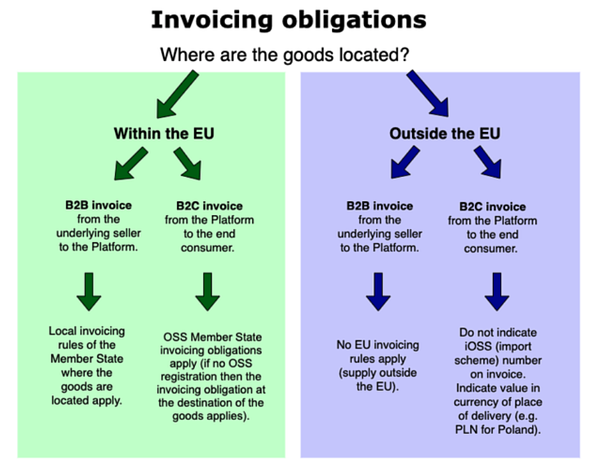

As per section 2.1.4.1 of the explanatory notes the deemed supply needs to be recognised through back-to-back invoices. If the goods are in the EU, the EI must receive an invoice from the underlying supplier as per the invoicing rules of the EU Member State where the goods are located (“B2B invoice”). There is a special exemption on this supply and no VAT is due. The deemed supplier can use the self-billing arrangement for these B2B transactions. In this case, the self-billing rules of the EU Member State where the supply takes place will apply.

For the B2C element of intra-EU transactions the deemed supplier that is registered with the OSS must invoice the end consumer. The invoicing rules of the Member State where the deemed supplier is registered apply here. If there is no OSS registration the invoicing rules of the destination Member State apply.

For goods that are imported into the EU there is no EU requirement for a B2B invoice from the underlying supplier to the platform as the deemed supply is outside the EU. For the B2C element, there is no EU invoicing obligation for importation when the IOSS scheme is used but a commercial receipt indicating the value in the local currency of the destination country is recommended. The IOSS number should never be mentioned on an invoice.

Credit: Taxamo's own image.

Potential additional obligation for the electronic interface

While we have outlined a series of implications for EIs from the content of the explanatory notes there is one crucial detail contained in section 4.1.4 of the notes. While the rules follow a common path there is one element that veers slightly from convention when the IOSS scheme is not used.

It is expected when goods imported from outside the EU and the IOSS scheme is not used the buyer of the goods will be liable for the VAT on collection of the goods. However, section 4.1.4 states the following: “If VAT becomes due upon importation into the EU in the Member State of final destination, that Member State can decide freely on the person liable to pay the import VAT (either the customer or the supplier or the electronic interface – Article 201 of the VAT Directive)."

We believe in such a scenario that France places the obligation for the collection and remittance of VAT on the EI thus adding complexity to the tax determination of such sales made via their platform. Affected EIs will now have to assess each EU Member State’s implementation of these rules to understand the implications and this may trigger additional reporting obligations.

Impact of new EU VAT rules on digital platforms

The obligation on online marketplaces is not only in terms of collecting and reporting VAT but also knowing more about their seller and the nature of the goods sold on their platform. Clearly the rules are significant for marketplaces with customers in the EU. What we see here will most likely be replicated in many more countries looking for ways to raise tax as a consequence of the increased demands placed on tax systems by the COVID pandemic.

It is important for marketplaces and sellers to understand what the impact of these new rules are and what they will need to do in order to comply with these rules from July 1, 2021.

Deloitte-Taxamo collaboration

Deloitte and Taxamo have collaborated on a new tax compliance service enabling marketplaces and sellers to register for VAT, automatically determine the correct VAT treatment of sales, submit VAT returns and remit payments of VAT to tax authorities. You can learn about the collaboration here.

PLEASE REMEMBER THAT THIS INFORMATION HAS BEEN PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND IS NOT PRESENTED AS SPECIFIC TAX OR LEGAL ADVICE. ALWAYS CONSULT A QUALIFIED TAX OR LEGAL ADVISOR BEFORE TAKING ANY ACTION BASED ON THIS INFORMATION. VERTEX INC. ACCEPTS NO LIABILITY FOR ANY LOSS RESULTING FROM ANY PERSON ACTING OR REFRAINING FROM ACTION AS A RESULT OF THIS INFORMATION.