DIFAL Law Finally Published in Brazil

In the first week of 2022, the Brazilian President sanctioned Complementary Law 190/2022 to properly regulate the collection of ICMS on interstate operations and services aimed at final consumers.

This is a consequence of the decision made by the Federal Supreme Court in the Direct Action of Unconstitutionality 5,469 in February 2021, which concluded that the changes promoted in relation to DIFAL by Constitutional Amendment 87/2015, would only be applicable with the issuance of a Complementary Law regulating the theme (that is, in compliance with the legislative rules imposed by the Brazilian Federal Constitution).

Due to the magnitude of this decision's impact on the states, the Supreme Court (STF) allowed the tax differential (DIFAL) to still be required without a complementary law until the end of 2021. That is, after this period, so that DIFAL can continue to be legitimately charged, the STF demanded the publication of a complementary law (meeting the requirements of the legislative process) to produce effects as of January 2022.

Therefore, on January 5th, 2022, the Complementary Law 190/22 was published, which did not bring material changes in relation to the DIFAL calculation mechanisms that were already being applied in 2021 but is generating a lot of controversy regarding the production of its effects, since it was not sanctioned by the President in 2021.

The new complementary law has not expressly indicated the effective timeframe, but only the related provisions of the Federal Constitution (CF/88 - art. 150, II, "c"). Consequently, there are already solid technical discussions regarding the application in combination with, or not, of the constitutional tax principles of "Anteriority Annual" (annual anteriority) and the "Noventena"(ninety days) - principles that aim to protect legal certainty, as well as the confidence of taxpayers about the amount expected to be paid to the public coffers in the next fiscal year.

On the one hand, the states understand that the ninety days principle (CF/88 – art. 150, II, "b") would be applicable in isolation, promising to charge DIFAL after 90 days from the publication of the new complementary law, in this case, April 6th, 2022.

On the other hand, taxpayers understand that the "Princípio da Anualidade" in this case, supersedes the "Noventena Principle", and that DIFAL cannot be charged still in 2022, that is, in the same year that the Complementary Law (which was instituted or increased) was published, and, can therefore only be charged in the following year (as of January 1st, 2023).

Unfortunately, the expectation is that the state tax authorities will, once again, decline to follow the constitutional mandates, forcing the requirement of DIFAL as early as 2022. This enables the taxpayer who may feel they need additional time, to file the appropriate lawsuits and preserve their right to delay paying until 2023.

What is DIFAL?

DIFAL was created to equalize the collection of ICMS (State Tax on the circulation of goods and services), in interstate transactions with non-ICMS taxpayers (companies or individuals). In the past, DIFAL was paid exclusively to states where sellers were located (origin), and states where consumers were located (destination) did not receive any portion of the tax.

However, events such as the growth of e-commerce, which consequently increased the circulation of products between states, led to significant changes, both in the calculation methodology and in the responsibility for collecting DIFAL, resulting in a fairer distribution of tax collection between states of origin and destination of goods and services, when destined for the final consumer.

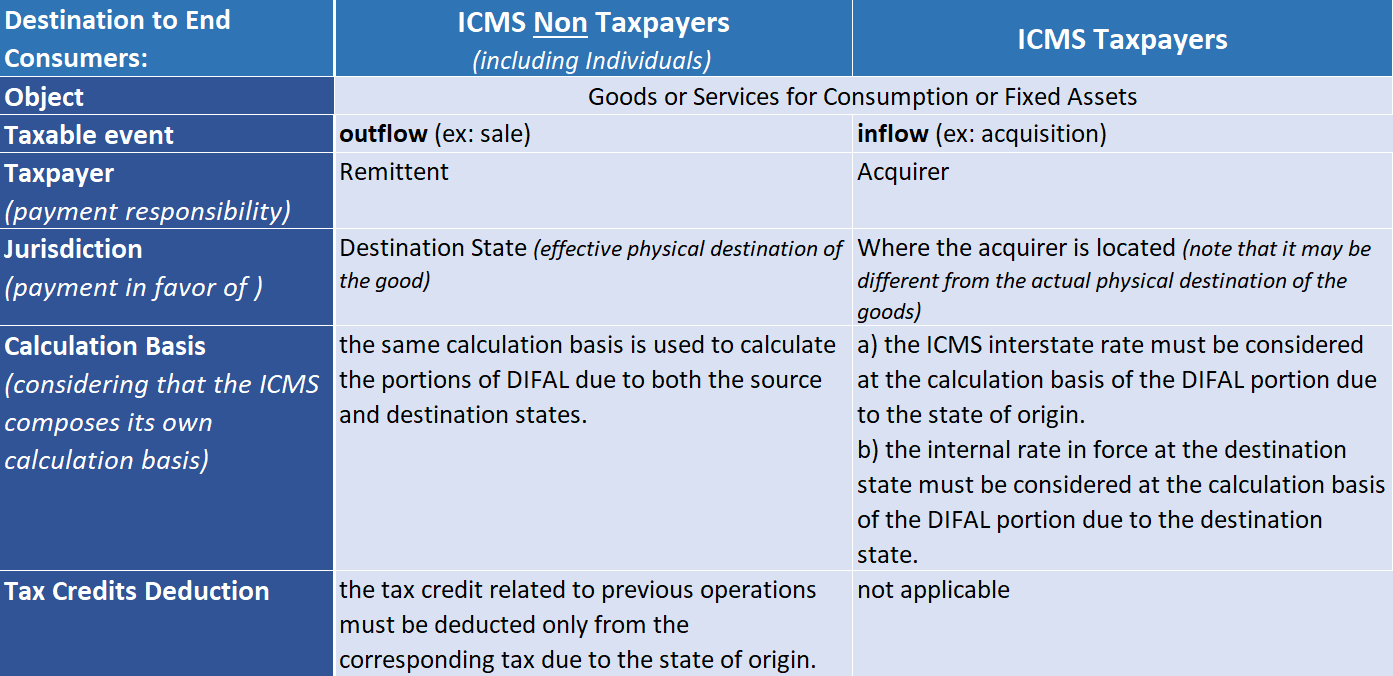

General aspects of DIFAL in force in 2021, as well as by the new Complementary Law 190/22, can be summarized as follows:

Disclaimer

Please remember that the Vertex blog provides information for educational purposes, not specific tax or legal advice. Always consult a qualified tax or legal advisor before taking any action based on this information. The views and opinions expressed in the Vertex blog are those of the authors and do not necessarily reflect the official policy, position, or opinion of Vertex Inc.

Blog Author

New Business Models In A New Global Landscape

In this e-book, we reveal key success factors for global expansion with our partners at SAP and Deloitte—covering everything from platforms and selling models, to legislation, tax, and customer experience.

Get E-Book