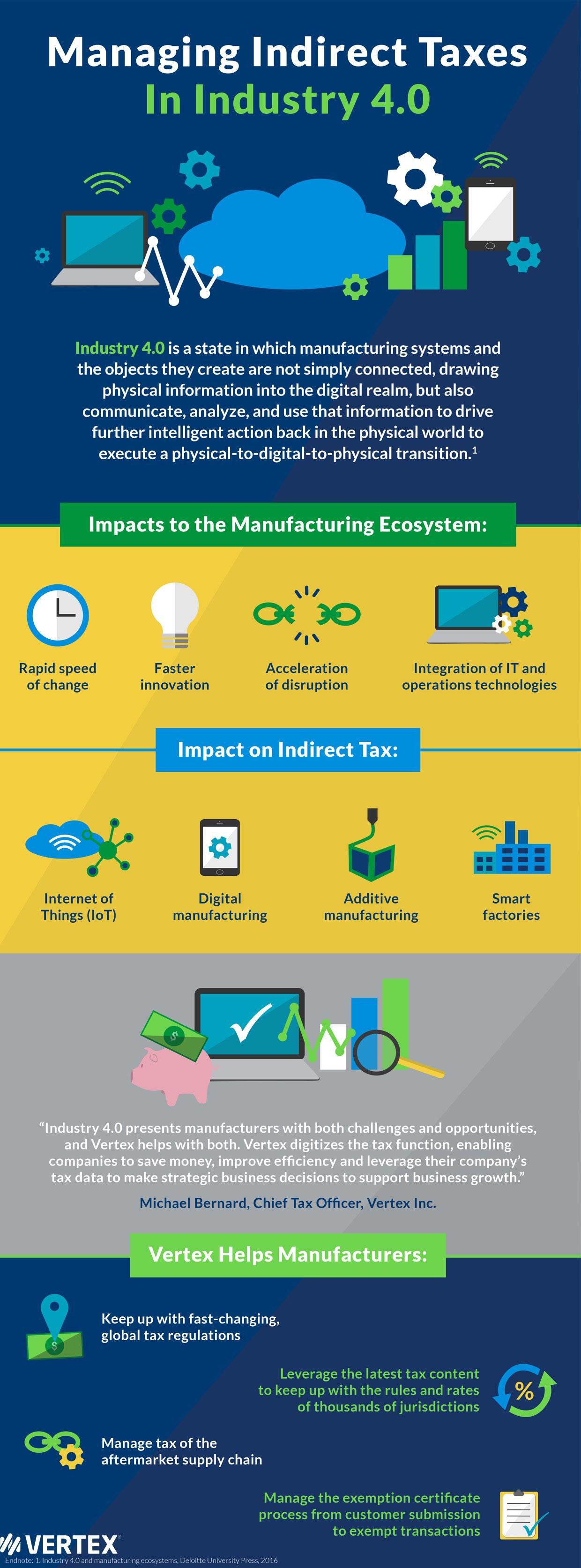

Managing Indirect Taxes in Industry 4.0

Explore Industry 4.0, what it means to manufacturers, and how Vertex can help companies make tax a platform to support business growth.

Overcome industry challenges ― digitize tax function

Industry 4.0 is a state in which manufacturing systems and the objects they create are not simply connected ― drawing information into the digital realm ― they’re also communicating, analyzing, and using that information to drive further intelligent action back into the physical world to execute a physical-to-digital-to-physical transition.1

“Industry 4.0 presents manufacturers with both challenges and opportunities, and Vertex helps with both. Vertex digitizes the tax function, enabling companies to save money, improve efficiency, and leverage their company’s tax data to make strategic business decisions to support business growth,” says Michael Bernard, Chief Tax Officer, Vertex Inc.

Learn more in this infographic:

Vertex helps manufacturers keep up with fast-changing tax regulations, manage aftermarket supply chain tax, and manage the exemption certificate process ― from customer submission to exempt transactions.

It's Time to Automate Transaction Tax

Every day, companies are transitioning from traditional, manual upkeep of sales tax to automation. Let us keep you compliant and free your organization from the burden of tax.

EXPLORE SOLUTION