Why Should You Add a Tax Engine to Your E-commerce System?

Explore the tax challenges e-commerce companies face and how to overcome them by using tax automation tools.

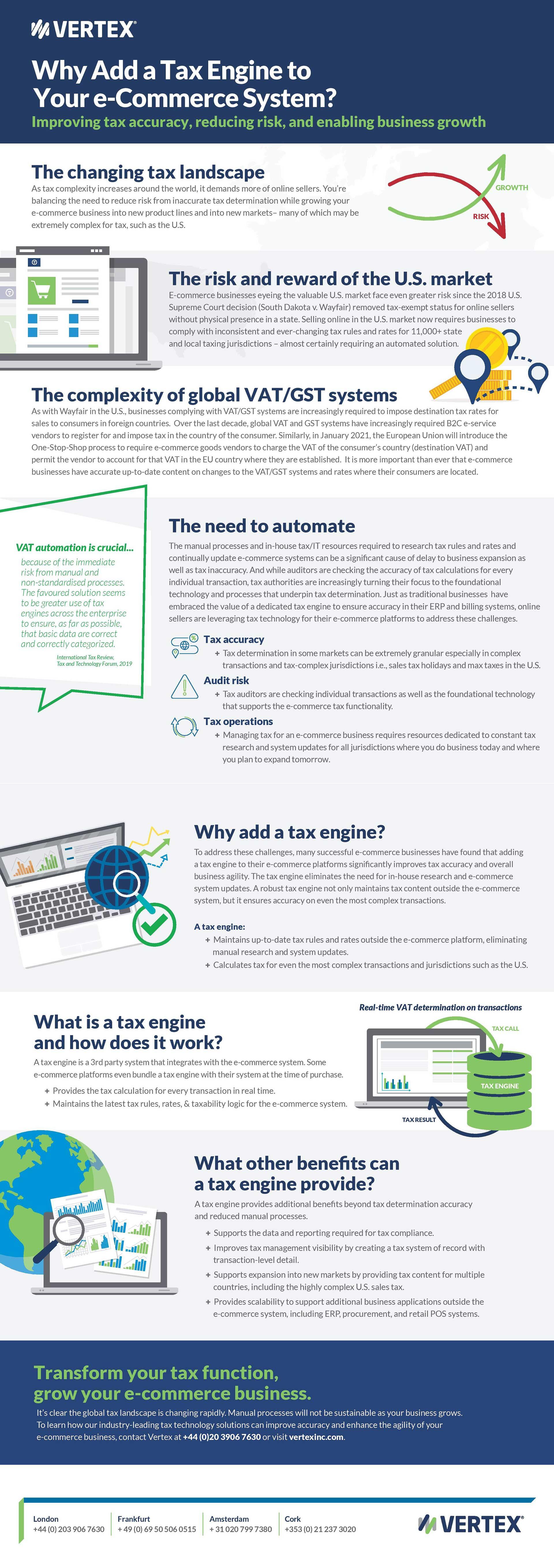

Improve tax accuracy, reduce risk, and enable business growth

Selling online in the U.S. market requires businesses to comply with inconsistent and ever-changing tax rules and rates for the 11,000+ state and local jurisdictions. The manual processes and in-house resources required to research new rules and rates, while continually updating e-commerce systems, can cause business expansion delays and contribute to tax inaccuracy. And while auditors are checking the accuracy of tax calculations for every individual transaction, tax authorities are increasingly turning their focus to the foundational technology and processes that underpin tax determination.

Just as traditional businesses have embraced the value of a dedicated tax engine to ensure accuracy in their ERP and billing systems, online sellers are leveraging tax technology for their e-commerce platforms to address these challenges.

Why you should add a tax engine ― and how it works

To ensure tax accuracy, protect against audit risk, and improve tax operations, many successful e-commerce businesses have added a tax engine to their e-commerce platforms. In addition to improved business agility, a tax engine eliminates the need for in-house research and e-commerce system updates. It not only maintains tax content outside the e-commerce system, it ensures accuracy on even the most complex transactions.

Simply stated, a tax engine is a third-party system that integrates with an e-commerce platform ― and some platforms even bundle a tax engine at the time of purchase. Tax engines provide tax calculation for every transaction in real time and they maintain the latest tax rules, rates, and taxability logic. They also support the data and reporting required for tax compliance while providing scalability to support additional business applications outside the e-commerce system ― including ERP, procurement, and retail POS systems.

Invest in growth with a tax solution for the e-commerce retail industry

Retailers are investing in digital transformation. Get a tax solution that provides an excellent and consistent customer experience across your sales channels, including e-commerce, marketplaces, drop-shipping, and more.

LEARN MORE