Vertex Named as a Leader in Worldwide SaaS and Cloud Tax Software

IDC MarketScape provides market assessments of ICT vendors to help technology leaders select the right one for their organization. These assessments use rigorous scoring methodology, looking beyond market share and providing a clear framework comparing each vendor’s product and service offerings, capabilities and strategies, and current and future market success factors.

Vertex was compared against industry competitors in three reports.

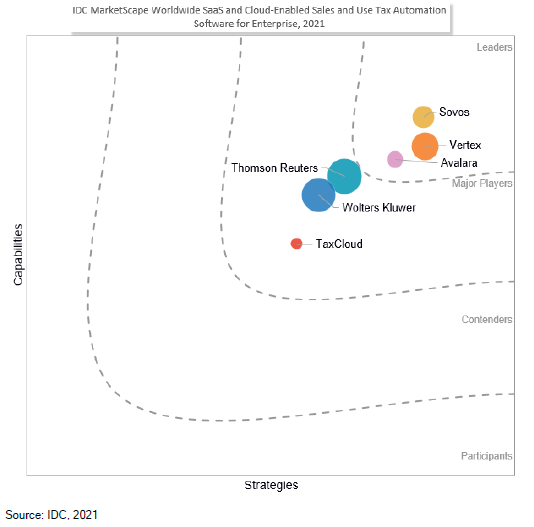

Report #1: Worldwide SaaS and Cloud-Enabled Sales and Use Tax Automation Software for Enterprise 2021 Vendor Assessment

Category Awarded: Leader

Why Vertex is a Leader:

- Specialized vertical expertise:

- We have a marquee client base with 59% of the Fortune 500.

- We offer indirect tax content and solutions tailored to the unique needs of products including communications, hospitality, leasing, manufacturing, and retail. We also offer specialty returns for food/beverage and business occupation returns.

- Supporting complexity:

- We can handle the most complex of business, tax, and technology scenarios.

- Through recent acquisitions, we offer solutions packaged and priced for midmarket and enterprise businesses.

- We support organizations throughout their life cycle, including supporting tax determination and compliance for over 19,000 tax jurisdictions globally, including tax calculation, cross-border logic, real-time customer location verification, invoice management for e-commerce, and filing and remittance.

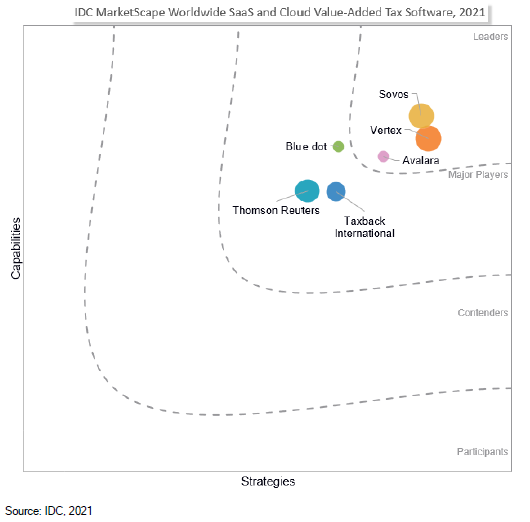

Report #2: Worldwide SaaS and Cloud Value-Added Tax Software 2021 Vendor Assessment

Category Awarded: Leader

Why Vertex is a Leader:

- Specialized vertical expertise:

- We have a marquee client base with 59% of the Fortune 500.

- We offer indirect tax content and solutions tailored to the unique needs of products including communications, hospitality, leasing, manufacturing, and retail. We also offer specialty returns for food/beverage and business occupation returns.

- Supporting complexity:

- We can handle the most complex of business, tax, and technology scenarios.

- Through recent acquisitions, we offer solutions packaged and priced for midmarket and enterprise businesses.

- We support organizations throughout their life cycle, including supporting tax determination and compliance for over 19,000 tax jurisdictions globally, including tax calculation, cross-border logic, real-time customer location verification, invoice management for e-commerce, and filing and remittance.

- Reporting and visibility:

- Our VAT compliance software offers integrated customizable rule-based data quality and validation tools, as well as workflow automation that maximizes data and return accuracy and minimizes the risk of liability.

- Users also have access to VAT/GST data and adjustments through drilldown capability from the return to transaction-level data.

- Users can edit or add data prior to filing, with complete version control.

- We also provide authorized users with access to audit event logs and detailed archives to support audit prep.

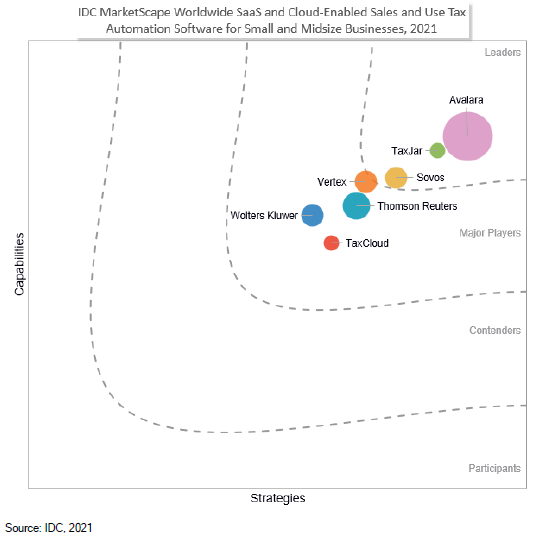

Report #3: Worldwide SaaS and Cloud-Enabled Sales and Use Tax Automation Software for Small and Midsize Businesses 2021 Vendor Assessment

Category Awarded: Major Player

Why Vertex is a Major Player:

- End-to-end tax management: We recently announced a product that facilitates the successful completion of online sales by small and midsize ecommerce sellers operating in the EU. This module is well suited for the needs of a business that would rather remove the need to register, file, and remit with IOSS. This offering integrates directly into the customer checkout journey and controls real-time VAT calculation, invoicing, and VAT number validation on the sales (i.e., goods consignment below €150).

Disclaimer: The opinions in these MarketScapes are those of IDC and do not necessarily represent the postings, strategies, or opinions of Vertex, Inc. The information contained therein is intended for information purposes only, may change at any time in the future, and should not be relied upon in making purchasing, legal, or tax decisions.

Explore Our Solutions

Discover how our technology solutions and software can help you streamline tax, stay compliant, and grow your business.

Browse All Solutions