Note: This blog has been updated to reflect VAT triangulation in 2021.

Leaving is easy. Transitions are difficult.

Companies affected by Brexit should keep that in mind given that the UK’s departure will require many organizations to conduct rigorous analyses and potentially implement changes to remain VAT compliant throughout Europe.

During the transition and settlement periods, the UK lost membership and safeguards of EU institutions. As a result, both EU and UK businesses should thoroughly analyze supply chains, financial processes and the underlying contracts to remain VAT compliant in the new regime.

For example, the UK will no longer enjoy the benefits of using VAT triangulation simplification when selling between EU member states. That’s a big shift for retailers and could cause major complications.

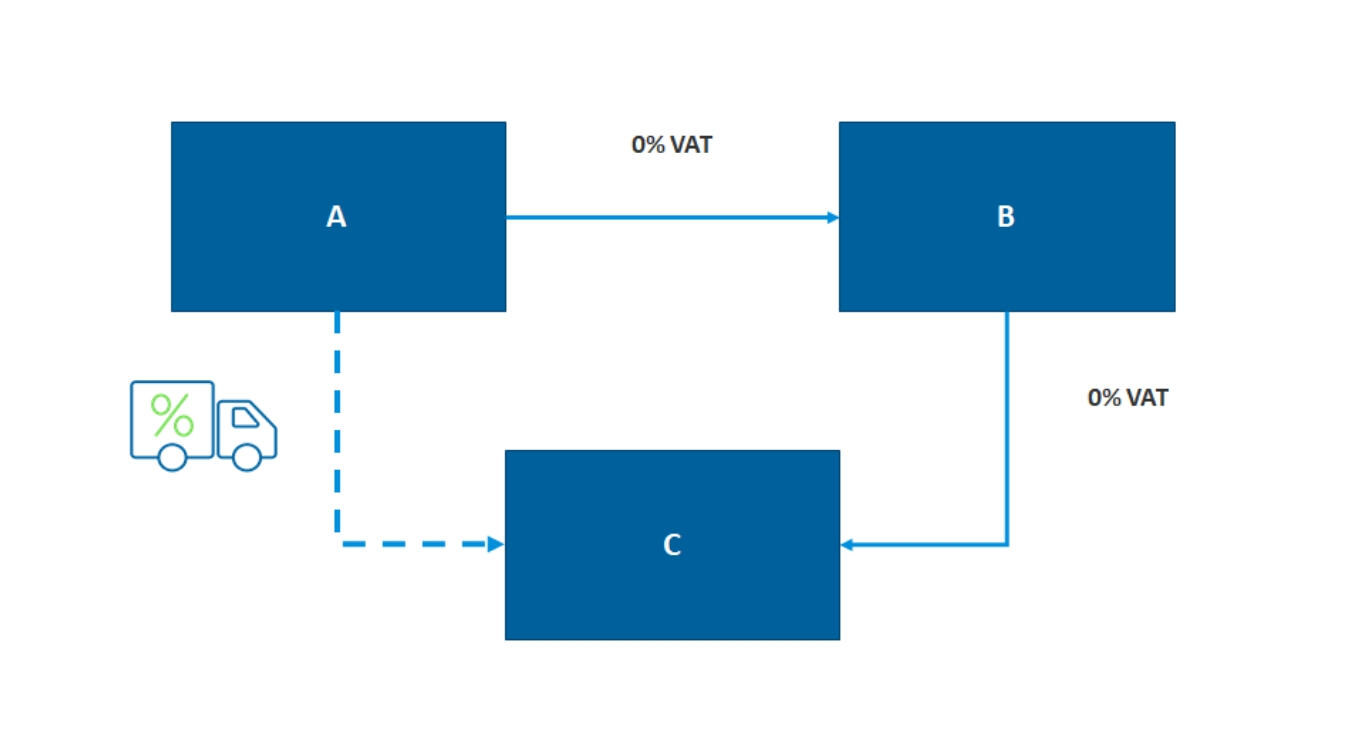

Simplified triangulation applies if three parties in three different EU member states supply goods and the first trader (A) ships the products directly to the third party (C) in the chain. In this scenario, both sales (A to B and B to C) can be treated as if these are zero-rated intracommunity supplies, and the middleman (B) is not required to register for VAT in the country of arrival of the goods.

Brexit affects both UK and EU businesses involved in triangular sales, and the actual impact depends on the role in the chain as the following three scenarios demonstrate.

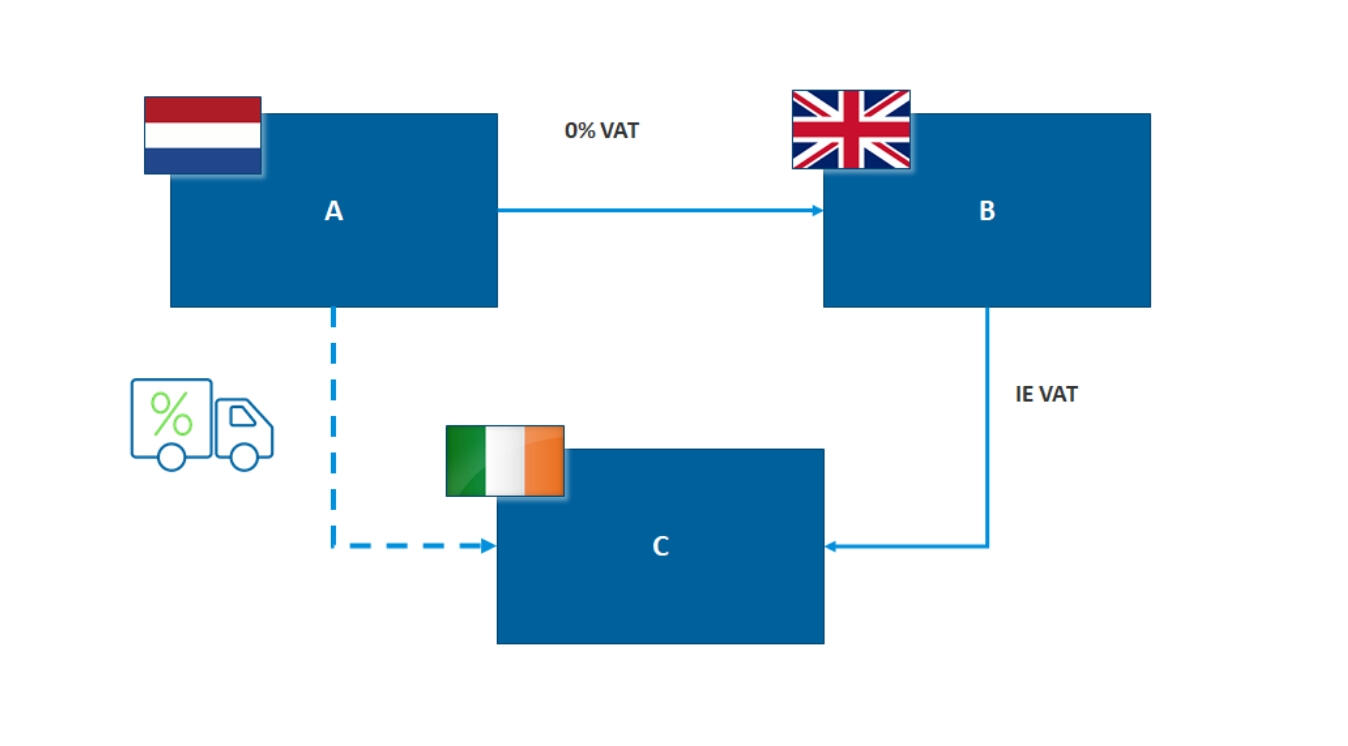

UK Middleman

This scenario triggers an intracommunity sale from The Netherlands to Ireland. The UK middleman B needs to register for VAT in Ireland (as this is the country where the goods physically arrive) and report a VAT acquisition in Ireland. In this example, the subsequent sale to the Irish customer is subject to local Irish VAT rules.

As the invoicing rules may differ per EU country, B may need to invoice local VAT or apply a domestic reverse charge (i.e., the customer reports the VAT). If B does not have an EU VAT registration, the Dutch manufacturer will have to charge Dutch VAT. This does not relieve the UK middleman from the obligation to register for VAT in Ireland and report an intracommunity acquisition.

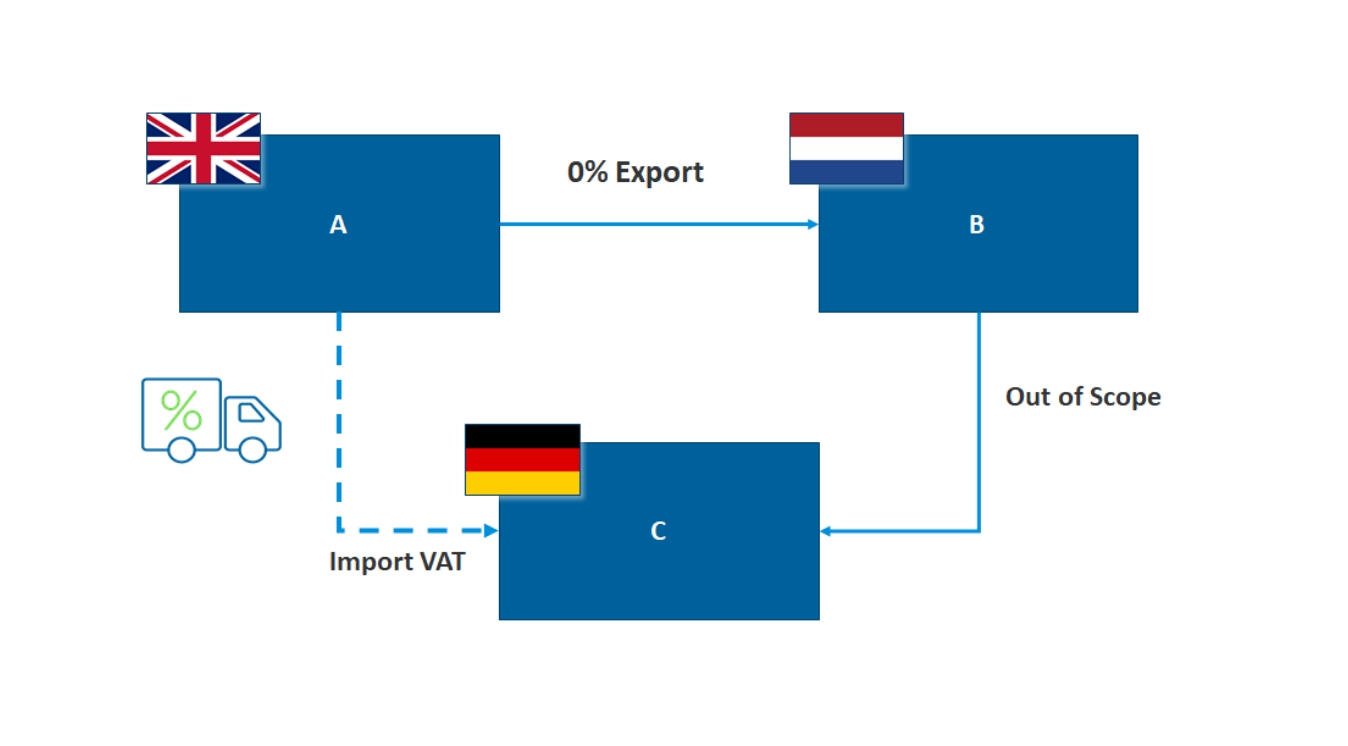

UK Manufacturer

In this scenario, the goods are exported from the UK by the UK manufacturer and imported into Germany by the final customer. The sale by the Dutch trader is out of scope for VAT and the German customer remits import VAT in Germany. However, here Incoterms and Customs regulations impact which party in the chain will and can act as the exporter from the UK or the importer in Germany, and the Incoterms may also impact the VAT liability.

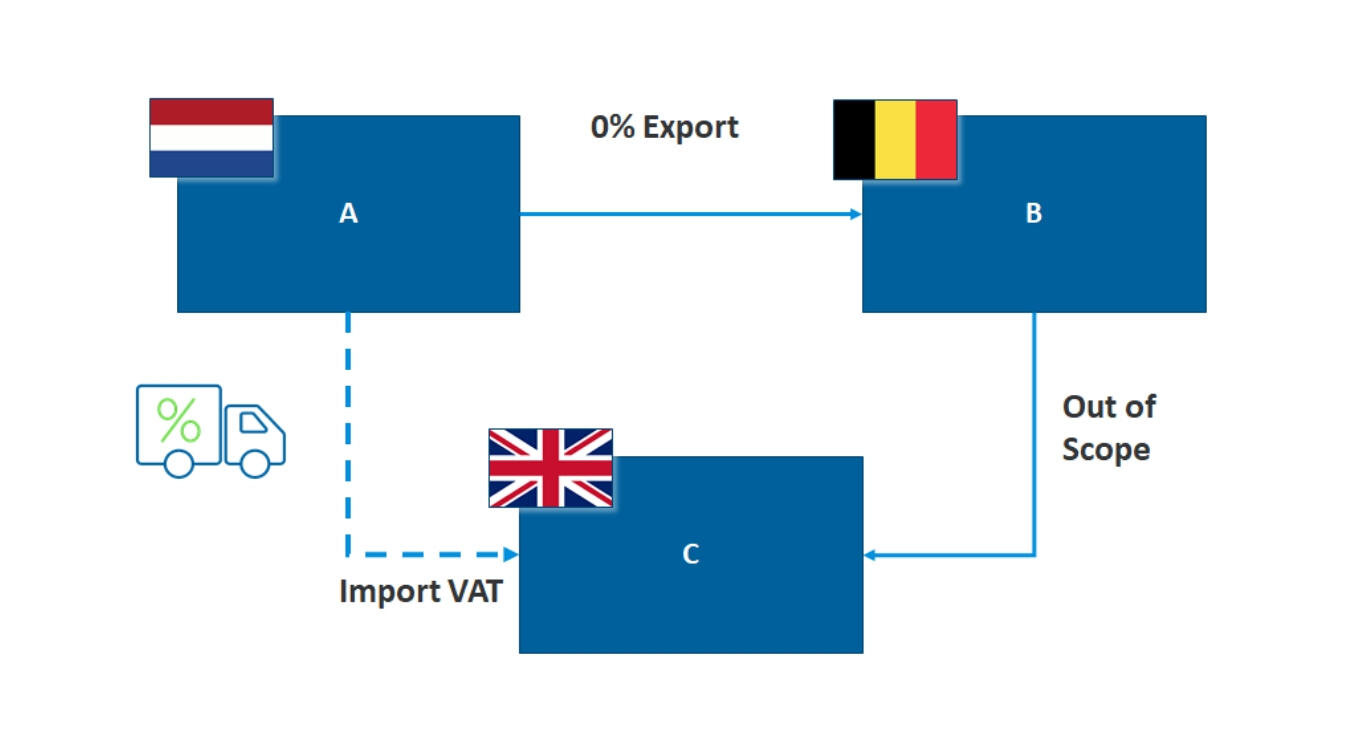

UK Final Customer

This scenario for VAT purposes is highly comparable to the previous situation where the goods originated from the UK. However, here an export from The Netherlands and an import into the UK occur.

In both of the above export/import scenarios, the middleman might prefer to be the importer or exporter of record to avoid transparency on who the manufacturer or final customer is (giving them an option to cut out the middleman) or to prevent the ultimate customer from gaining insights into the commercial values of the first transaction (A to B) through customs documentation.

So, what should you do?

- The middleman should analyze the supply chain to assess if simplified triangulation is currently applied, and if Incoterms should be included in this review.

- Next, determine which party in the chain will be the exporter or importer and who should assume VAT liability in the country of import.

- Where needed and possible, contracts and Incoterms should be adjusted, or VAT and EORI registrations must be put in place.

- The middleman should review the import-export process and documentation to avoid unwanted side effects due to increased transparency.