Increase Tax Data Accuracy

Validate, enrich, and transform the tax transaction data required to properly support the end-to-end indirect tax compliance process.

Leverage an integrated global tax data management system to streamline the tax data validation process, enhance data quality, and have confidence in your readiness for indirect tax compliance.

Simplify data management processes and improve your tax transaction data quality. Benefit from more accurate data in your indirect tax returns – reducing the risk of audits and penalties.

As your business expands, leverage tax data systems, management, and insight tools designed to support high volumes of data.

Validate, enrich, and transform the tax transaction data required to properly support the end-to-end indirect tax compliance process.

Reduce overpayments in sales and use tax or maximise VAT reimbursements with enhanced data quality and a detailed audit trail.

Utilise tax data analytics and insights software to identify common and recurring data errors so they can be eliminated from your source systems.

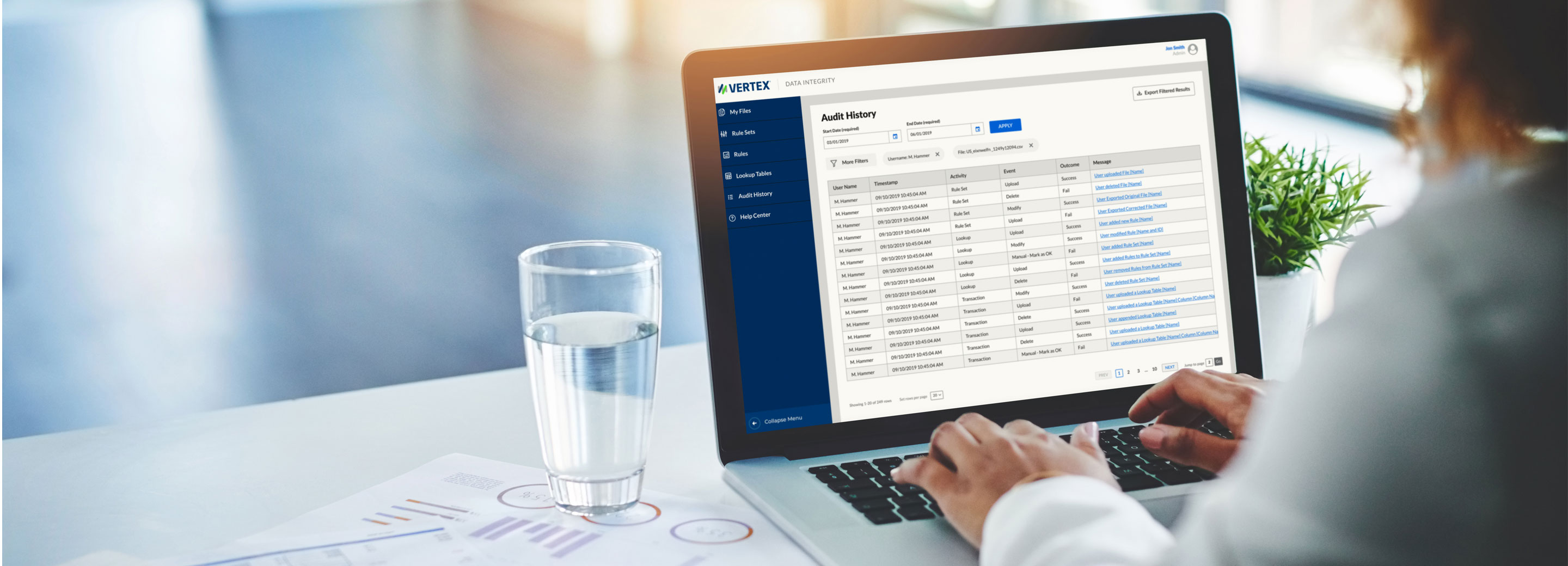

Increase the ability to document changes made to the tax transaction data included in your indirect tax return, providing transparency and a valuable audit trail for your business.

Produce signature-ready returns for sales tax, use tax, and value added tax (VAT).

Enable the data validation, analysis, and transformation steps required to support indirect tax compliance.

This infographic illustrates how Vertex Cloud Data Integrity helps companies reduce their audit exposure and increase tax staff efficiency.

View the infographic to learn how re-balancing tax department activities is the first step to elevating the strategic value of the tax department, and how data intelligence is the key.

We harness the strengths and abilities of our partners and alliances to deliver trusted tax solutions to businesses across the globe.