On 15 April, the UK resumed Brexit-related trade deal negotiations, via video, with the European Union (EU) following a two-month delay caused by COVID-19.

Implications for Duties & Tariffs on UK-Related Trade

What happens next—not only with the UK’s EU trade negotiations but also concerning the new deals it needs to sign with numerous other global trading partners—will have major implications for duties and tariffs on UK-related trade as well as global companies with a significant UK presence.

The two-month delay in UK-EU negotiations was significant and could prove positive in the end. Given COVID-19’s bruising economic impacts, the International Monetary Fund (IMF) proposed extending the Brexit transition period beyond the 31 Dec deadline, which could offer the UK more time to complete trade deals with EU countries. However, UK Prime Minister Boris Johnson has indicated the UK will not ask for another extension, still leaving precious little time to complete a deal with EU countries—and with all other nations the UK trades with.

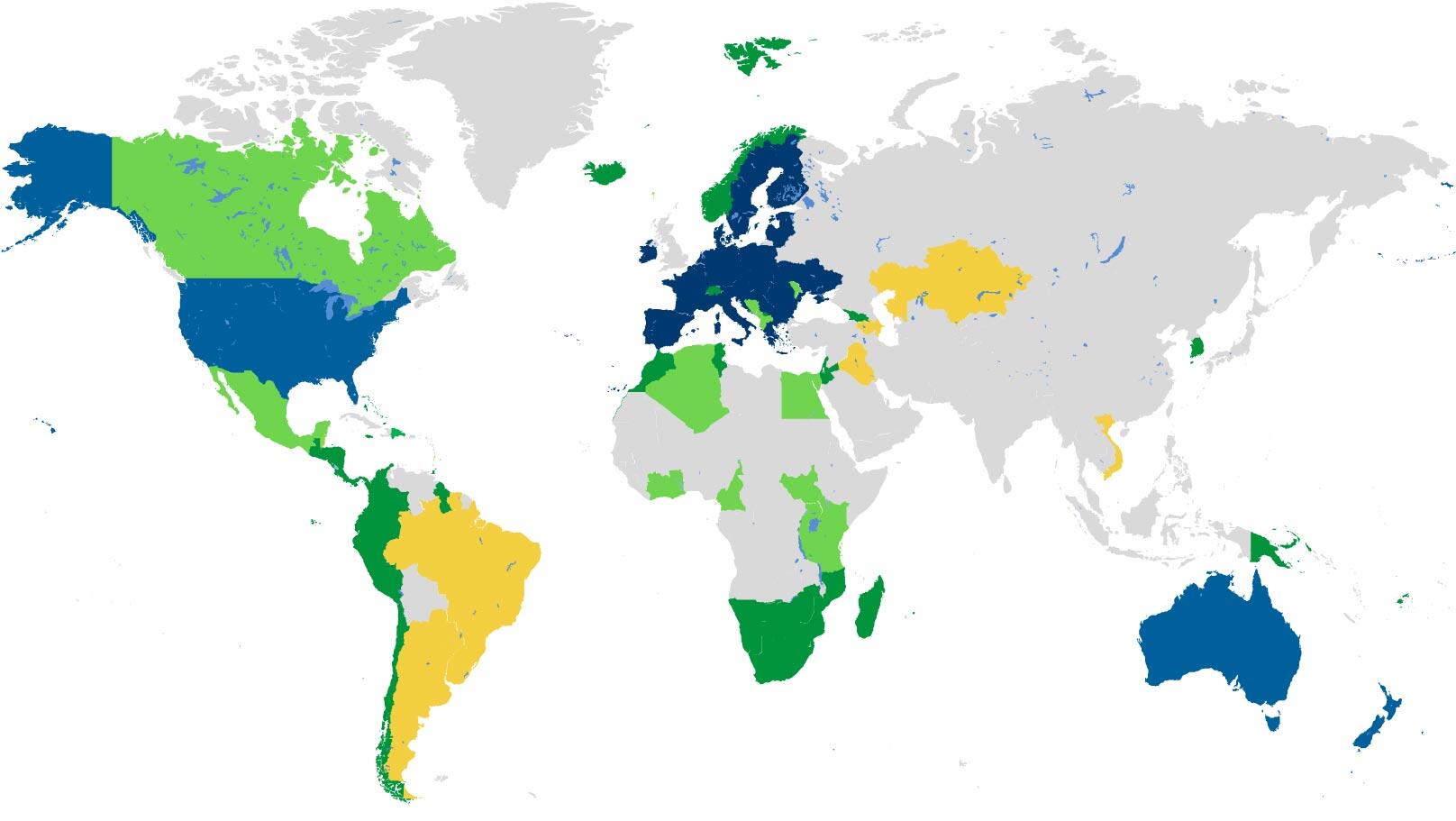

To be sure, a UK-EU trade agreement remains crucial, given that 46% of UK exports go to EU countries and 53% of UK imports are from EU counties. That said, the UK also must reach new trade agreements by the end of this year with many other countries. The illustration below shows where the UK currently stands with regard to all of its global trade deal negotiations.

UK's Stance with Regard to Global Trade Deal Negotiations

Key

- Dark Blue: EU countries (negotiations have re-started, but are not finalised)

- Dark Green: Countries with which the UK has signed new trade deals (expected to take effect 1 Jan 2021)

- Bright Green: Countries with which the UK is currently negotiating

- Bright Blue: Countries with which the UK has signed mutual recognition agreements. These agreements with the U.S., Australia and New Zealand effectively replicate the pre-Brexit EU terms that previously governed these same trading relationships. (These are not trade deals but arrangements under which countries recognise the results of a set of processes that confirm products meet specific requirements.)

- Yellow: Countries with which the UK has yet to initiate trade negotiations (the EU has a trade agreement with these countries)

- Grey: Countries without an EU trade deal and no negotiations with the UK (yet) At this point, it seems likely that the UK will finalise an arrangement with the South American trade bloc Mercosur (which includes Brazil) given that the Brazilian government has indicated it is seeking a trade deal that is similar to the agreement it currently has with the EU (and given that UK exports to Mercosur are substantial).

2020 UK Timeline & Outlook

Trade deals typically require more than two years to hammer out, so the UK’s progress to date—despite its compressed timeline and the global pandemic—is certainly impressive. However, more progress will be needed in leading up to 31 Dec, especially concerning the UK’s negotiations with the EU. Without a trade deal, UK transactions with the EU would be subject to duties under World Trade Organization (WTO) rules.

Disclaimer

Please remember that the Vertex blog provides information for educational purposes, not specific tax or legal advice. Always consult a qualified tax or legal advisor before taking any action based on this information. The views and opinions expressed in the Vertex blog are those of the authors and do not necessarily reflect the official policy, position or opinion of Vertex Inc.