Vertex Indirect Tax Intelligence

Data-driven insights to improve tax compliance and drive business decision-making.

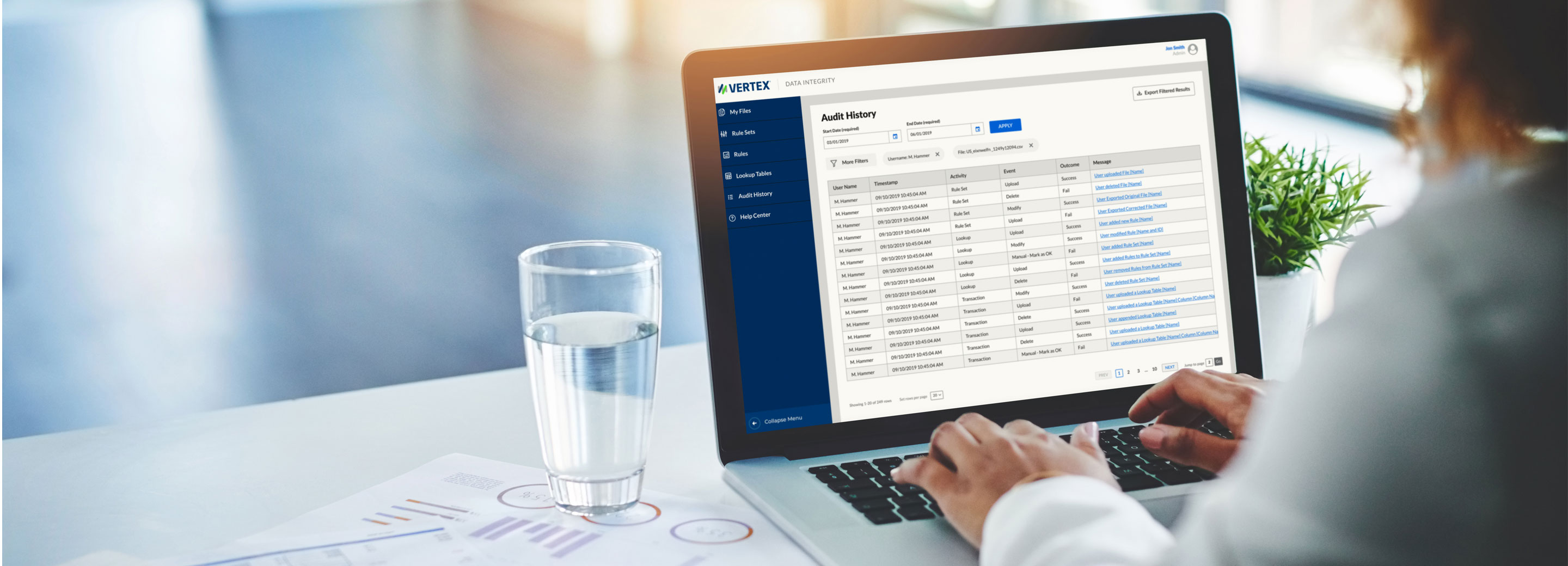

Tools to improve data quality and provide data intelligence to optimise the end-to-end tax process.

Improve tax performance and drive better business decision-making with powerful data tools. Our tax-specific solutions unlock the full value of your data to improve compliance and audit performance, helping you accelerate business growth.

View your tax data in new ways to identify areas for focus. Make your data your most powerful tool to help reduce audit risk and accelerate growth.

Turn raw data into actionable insight to drive better outcomes. Integrated, tax-specific data tools can improve compliance and audit performance, helping drive better decision-making.

Leverage powerful big data tools like machine learning to jump-start complex product mapping. Bring a new level of speed and consistency to your tax function.

Become a more proactive tax function. Highlight exposure and risk to mitigate it sooner. Uncover trends, highlight exposure and risk, and help your organisation focus on what matters most.

Turn raw tax data into actionable insight.

Drive better outcomes with Vertex data intelligence tools. Our data and insight solutions unlock time, capacity, and insight to help optimise compliance and audit performance, mitigate risk, and improve tax outcomes.

Data-driven insights to improve tax compliance and drive business decision-making.

Allow your system to work for you. Utilise Vertex support and services where and when you need them to help support frictionless commerce.

Benefit from the deep experience of Vertex Consulting to implement, migrate, or upgrade your Vertex system.

Get the support you need to maximise the capabilities of your Vertex system and optimise performance.

FAQs

Tax data analytics involves using data tools to analyse tax liabilities, trends, and risks. It helps finance and tax teams make more informed decisions and helps ensure transparency and compliance across global operations. In the US, having a view into sales by state can be used to monitor thresholds and know when to register and start collecting tax. Learn about the Vertex solution for tax data insight.

Reporting dashboards give tax teams real-time insights into transaction taxes, filing statuses, compliance gaps, and audit readiness. Dashboards can also help monitor KPIs and improve collaboration with finance, legal, and IT.

Transparent tax data helps ensure internal consistency, facilitates cross-border compliance, and builds trust with tax authorities. It also supports strategic initiatives like M&A, supply chain restructuring, and sustainability reporting. Proper visibility minimises the internal effort to scale and stay compliant as your system, teams, or business expands.

Yes. Tax insights highlight potential red flags—such as incorrect tax rates or late filings—before they escalate. Proactive attention to analytics enable teams to fix errors early and reduce audit exposure.

Tax data reveals patterns that can inform pricing strategies, expansion plans, and investment decisions. It helps ensure tax implications are factored into high-level planning, which can reduce costly surprises down the road.

Discover up-to-date insights and connect to the latest trends in tax technology with our resource library, featuring the latest research, whitepapers, e-books, webcasts, infographics and more.